The rapid urbanization, sharp economic growth of India and increasing population, coupled with air pollution problems and high oil import bills, have driven the Indian government to look for alternative sustainable as well as environmentally friendly solutions aimed at reducing its dependence on fossil fuels. One viable solution is bioethanol chosen by the Govt. which offers a range of economic, social, and environmental benefits – including new demand for crops, boosting employment, farmers’ income and reducing harmful emissions.

According to the Indian government, greenhouse gas (GHG) emissions decreased by 54.4 million metric tons between the ethanol supply years (ESYs) 2014 and 2024, thanks to interventions linked to the India Ethanol Blending Program (EBP) which resulted substitution of 18.1 million metric tons of crude oil during the same period. Despite challenges, such as feedstock availability, their variability and technological limitations, policymakers and producers are addressing these challenges through improved policies, regulations, and technological advances with great agility. In this article, let’s explore the current state of bioethanol production in India, including political incentives, challenges faced by producers, and growth opportunities.

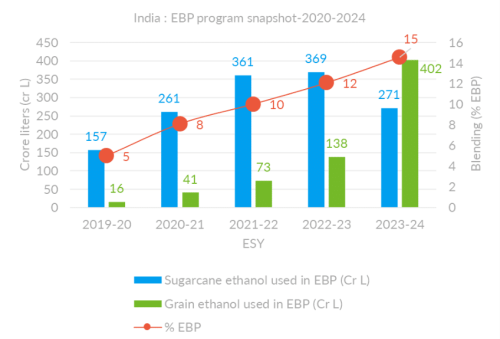

Current ethanol production allowing a new blending record

In the current Ethanol Supply Year (ESY) 2024-25, India is steadily approaching towards E20: ethanol blending in petrol reached 19.7% in February with 79.5 crore liters ethanol blended in petroleum, while the cumulative average ethanol blending from November 2024 to February 2025 stood at 18% with a total of 302.5 crore liters of ethanol blended.

India’s capacity to produce ethanol increased remarkably from 518 crore liters in 2017–2018 to 1623 crore liters in 2023–2024 – including sugarcane-based, grain-based and dual feed-based. The grain-based ethanol capacity accounts for ~40% of total capacity.

Investigating the nation’s ethanol production reveals a distinct regional distribution. The Northern region reigns supreme with a 39% share, followed by the West (32%), South (21%), and East (8%) in 2023. This dominance can be attributed to the North’s massive ethanol production capacity and robust agricultural sector, particularly in states like Uttar Pradesh, Punjab, and Haryana. Uttar Pradesh has topped the country in the field of ethanol production. In the last eight years, the state has increased its production capacity to 2 billion liters (200 crore liters) per year and the target is to increase it to 2.5 billion liters per year in the future.

Political incentives on the Indian ethanol market

Although India’s ethanol industry is growing, the country still relies on oil imports, leaving it vulnerable to fluctuations in global markets. In response, the Indian government set ambitious goals – in its National Policy on Biofuels – to increase domestic bioethanol production and decrease reliance on foreign oil, aiming for a 20% blending rate with petroleum by 2025 [2]. To do so, India is facilitating and subsidizing entrepreneurs in setting up new distilleries or expanding existing ones, whether molasses-, grain-, or dual-feed-based.

To further encourage bioethanol production, the Government of India is promoting alternative feedstocks such as surplus grain, rather than exclusively damaged grain, to meet the feedstock needs. Additionally, India promotes the use of corn for multiple reasons: its high potential as a raw material for ethanol, its higher market price support for farmers, and its higher agricultural yield. Corn production is expected to rise by 10 million metric tons over the next 5 years – allowing for more conversion into ethanol.

On the consumer side, vehicle-makers have introduced FlexiFuels and E-20-compatible vehicles to the Indian market. However, access to E-20 fuel remains limited, with only 100 stations in metropolitan cities and a limited storage infrastructure. To create a virtuous circle around ethanol production and consumption, the government is encouraging the domestic manufacture of these vehicles as part of the “Make in India” initiative.

These policies, goals, and investments demonstrate the government’s commitment to the bioethanol industry, to reduce India’s dependence on fossil fuels.

Challenges and opportunities faced by Indian bioethanol producers

Bioethanol producers are facing several challenges, with a struggle to keep up with increasing feedstock prices, low prices for DDGS from corn ethanol, and the ban on the Food Corporation of India’s rice supply. Besides, India’s monsoon rains have recently been below normal, consequently leading to decreased rice and sugarcane crops. One of the consequences of this dynamic would be failing to meet the set 20% blending target with petroleum by 2025.

Nonetheless, many opportunities exist that the Indian bioethanol industry can leverage.

One comes from the Global Biofuels Alliance recently formed during 2023 G20 Summit, through which India has the potential to triple its biofuel use in the next five. Through boosting the use of sustainable biofuels and enabling advances in technology, the Global Biofuels Alliance aims to make biofuels a more integrated part of the world’s energy mix. This represents a significant opportunity for the Indian bioethanol industry to expand its reach and influence towards a sustainable future.

Additionally, Indian ethanol producers have a direct role to play in driving the growth of the industry and promoting sustainable production practices. Indeed, robust, and efficient processes lead to increased efficiency, greater ethanol productivity, and reduced costs.

High-gravity fermentation is one of the various ways to reduce energy consumption and effluents during ethanol production. By reducing their energy consumption, producers can decrease the environmental footprint and cost of their process, directly contributing to greener, more profitable, and more efficient productions.

In conclusion, the Indian bioethanol industry is poised for growth with significant potential for innovation and advances in technology.

Ultimately, new technologies and innovative practices will contribute to a more prosperous bioethanol market dynamic. Whether with second-generation bioethanol gaining weight in the coming years or the potential introduction of new generations of yeasts in the Indian market, the opportunities are numerous and have already started to flourish. The expected demand for bioethanol in sustainable aviation fuels can boost the production of biofuels and lead to greater energy efficiency while making a significant contribution to reducing greenhouse gas emissions.

The recent advances and political incentives in promoting sustainable ethanol production and reducing dependence on traditional fossil fuels provide hope and optimism for the future.